Managing finances effectively is crucial for individuals and businesses alike. One of the most significant challenges people face is keeping track of payments, whether it's for loans, mortgages, or other financial obligations. A well-structured payment schedule can help make timely payments, reduce debt, and improve overall financial health. In this article, we'll discuss the importance of payment schedules and provide you with 7 free printable payment schedules that you can use today.

Why Use a Payment Schedule?

A payment schedule is a detailed plan that outlines when payments are due, how much is owed, and the frequency of payments. Using a payment schedule can help you stay organized, avoid late fees, and make progress towards paying off debt. Here are some benefits of using a payment schedule:

Improved financial organization: A payment schedule helps you keep track of multiple payments, due dates, and amounts owed. Reduced late fees: By making timely payments, you can avoid late fees and penalties that can add up quickly. Increased financial discipline: A payment schedule helps you stick to your financial goals and make consistent progress towards paying off debt. Better credit score: Making on-time payments can help improve your credit score over time.

Types of Payment Schedules

There are several types of payment schedules, including:

Weekly payment schedule: A schedule that outlines payments due on a weekly basis. Bi-weekly payment schedule: A schedule that outlines payments due every two weeks. Monthly payment schedule: A schedule that outlines payments due on a monthly basis. Quarterly payment schedule: A schedule that outlines payments due every three months.

7 Free Printable Payment Schedules

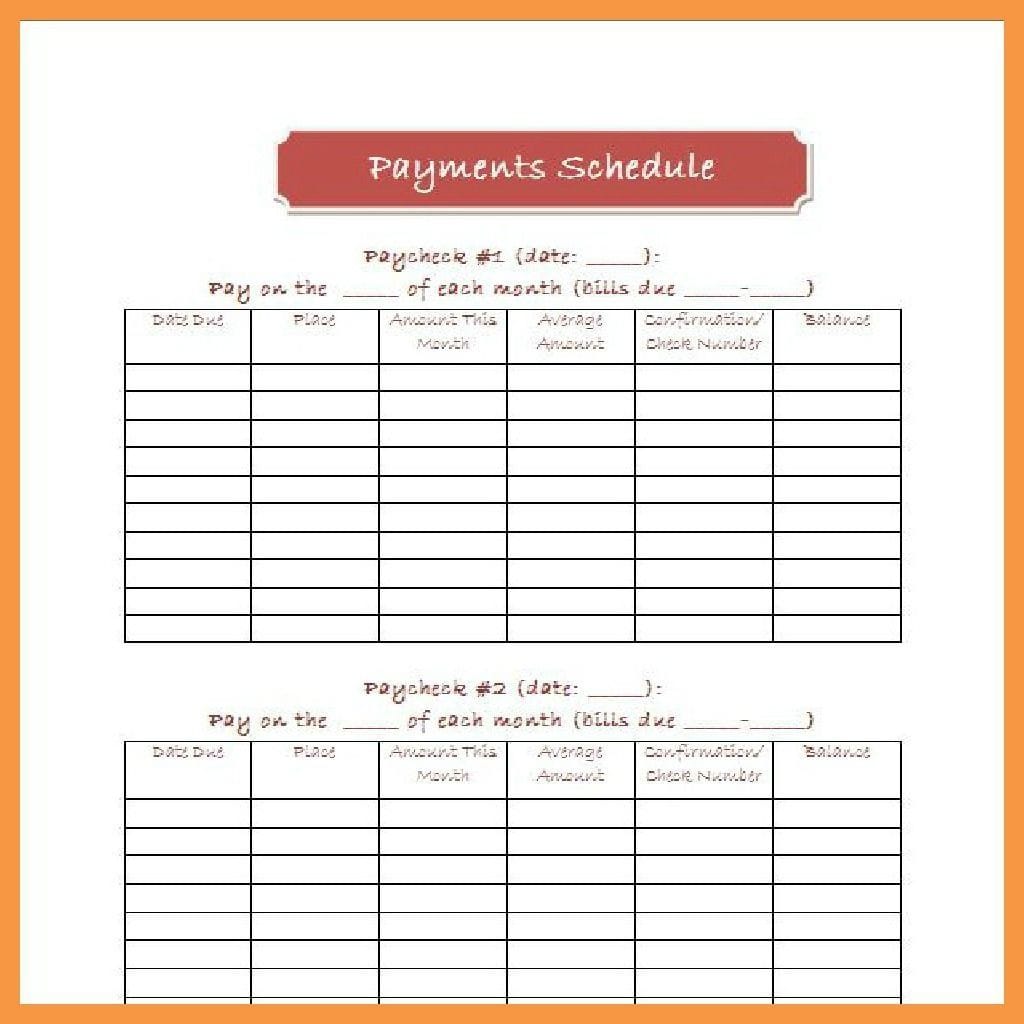

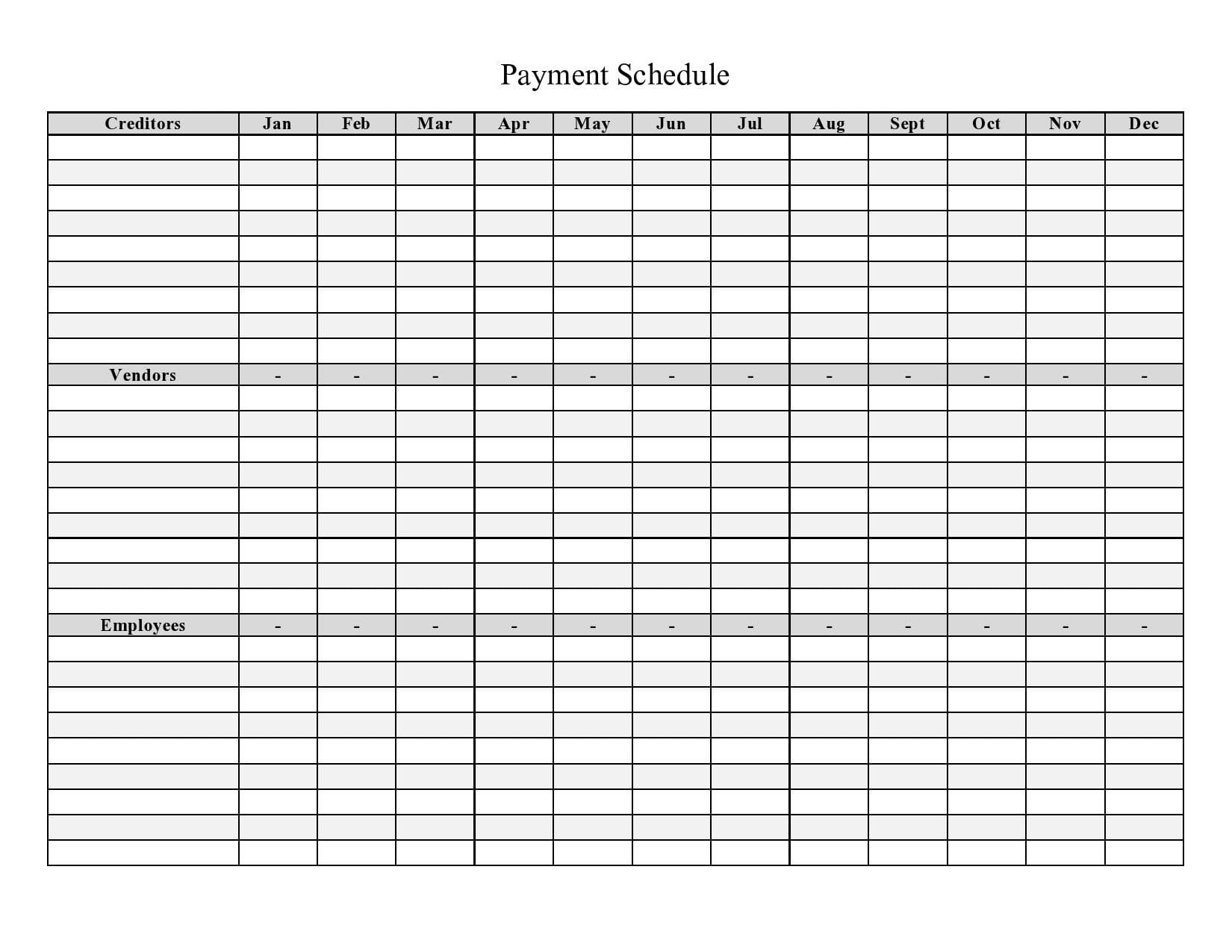

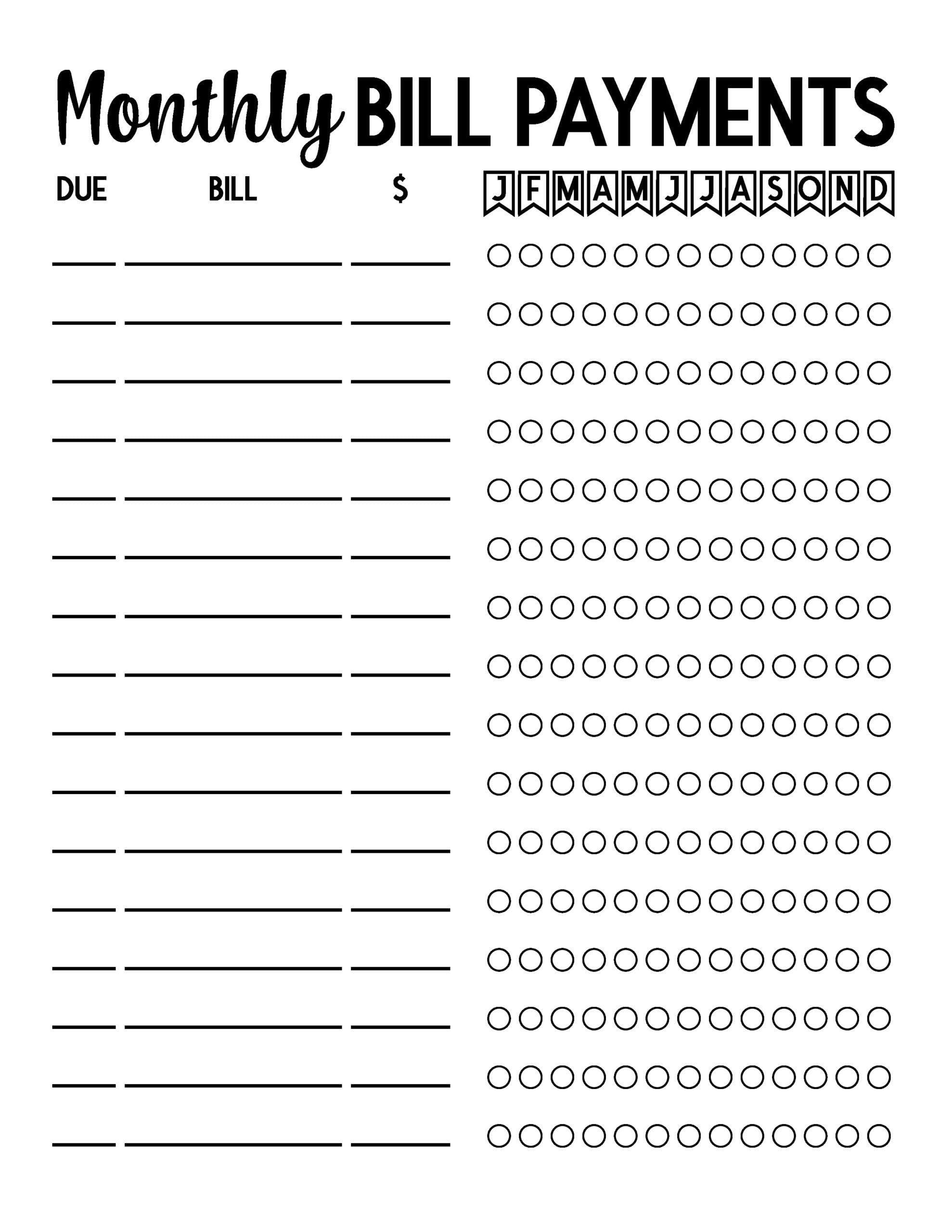

Here are 7 free printable payment schedules that you can use today:

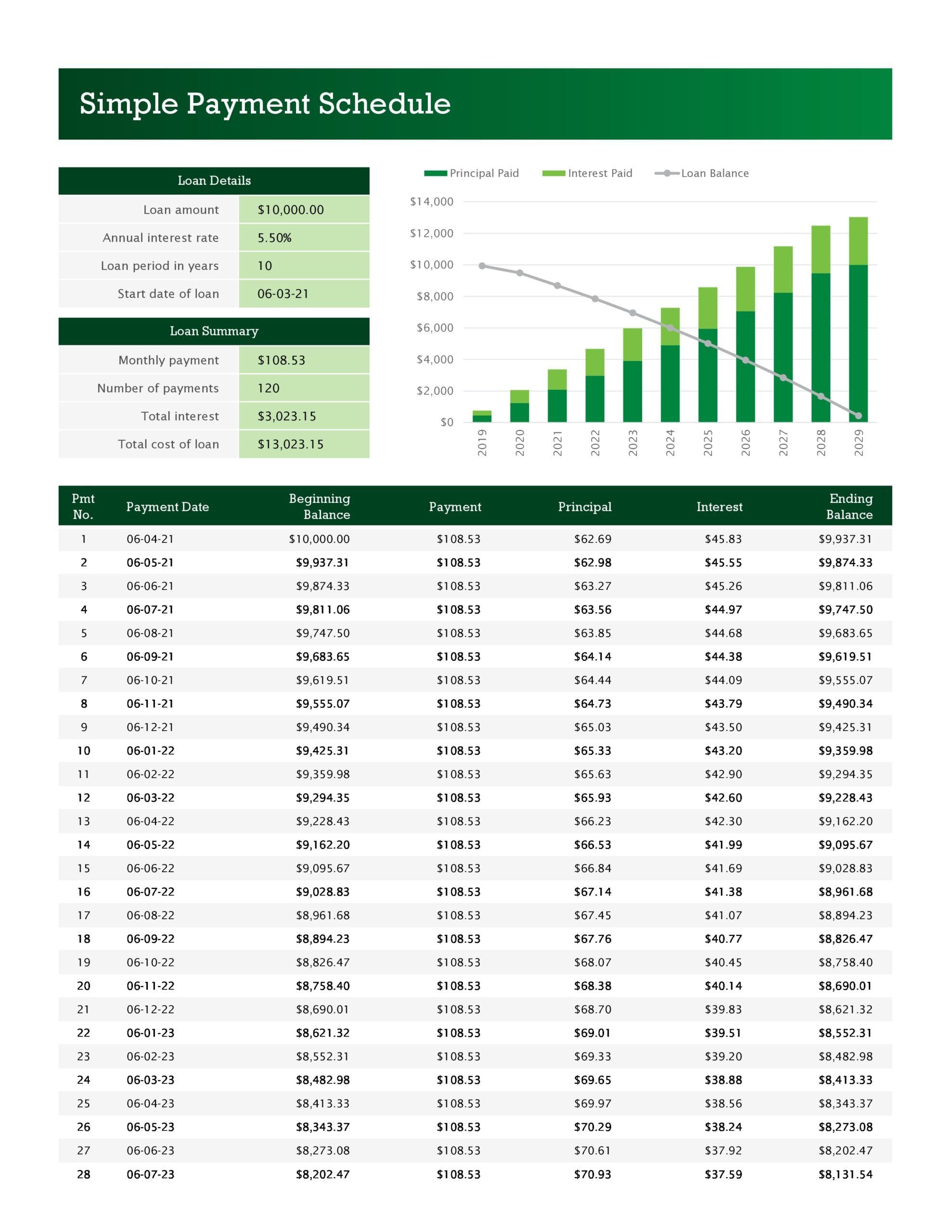

- Simple Payment Schedule: A basic payment schedule that outlines payments due, amount owed, and payment frequency.

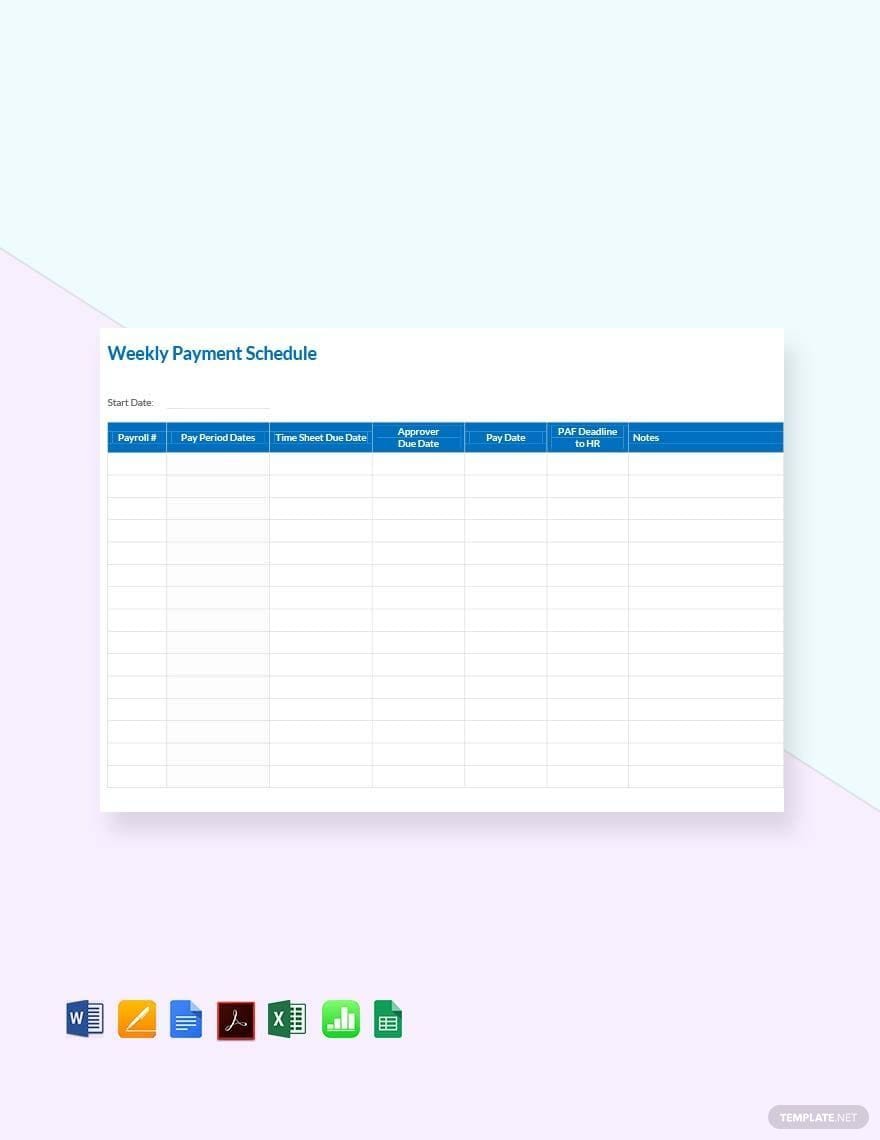

- Weekly Payment Schedule: A schedule that outlines payments due on a weekly basis.

- Bi-Weekly Payment Schedule: A schedule that outlines payments due every two weeks.

- Monthly Payment Schedule: A schedule that outlines payments due on a monthly basis.

- Quarterly Payment Schedule: A schedule that outlines payments due every three months.

- Annual Payment Schedule: A schedule that outlines payments due on an annual basis.

- Customizable Payment Schedule: A schedule that allows you to customize payment due dates, amounts owed, and payment frequency.

How to Use a Payment Schedule

Using a payment schedule is straightforward. Here's a step-by-step guide:

- Determine your payment frequency: Decide how often you want to make payments, whether it's weekly, bi-weekly, monthly, or quarterly.

- Identify your payment due dates: Mark down the specific dates when payments are due.

- Calculate your payment amounts: Determine how much you need to pay each period.

- Fill out the payment schedule: Use the template provided to fill out the payment schedule with your payment due dates, amounts owed, and payment frequency.

- Track your payments: Use the payment schedule to track your payments and stay on top of your financial obligations.

Tips for Using a Payment Schedule Effectively

Here are some tips for using a payment schedule effectively:

Set reminders: Set reminders for payment due dates to ensure you never miss a payment. Automate payments: Consider automating payments to make it easier to stick to your payment schedule. Review and adjust: Regularly review your payment schedule and adjust as needed to ensure you're on track to meet your financial goals.

Conclusion

Using a payment schedule can help you stay organized, reduce debt, and improve your overall financial health. By following the steps outlined in this article and using one of the 7 free printable payment schedules provided, you can take control of your finances and achieve your financial goals. Remember to set reminders, automate payments, and regularly review and adjust your payment schedule to ensure you're on track to success.

What is a payment schedule?

+A payment schedule is a detailed plan that outlines when payments are due, how much is owed, and the frequency of payments.

Why is it important to use a payment schedule?

+Using a payment schedule can help you stay organized, reduce debt, and improve your overall financial health.

How do I use a payment schedule effectively?

+To use a payment schedule effectively, set reminders, automate payments, and regularly review and adjust your payment schedule to ensure you're on track to meet your financial goals.

Gallery of 7 Free Printable Payment Schedules You Can Use Today