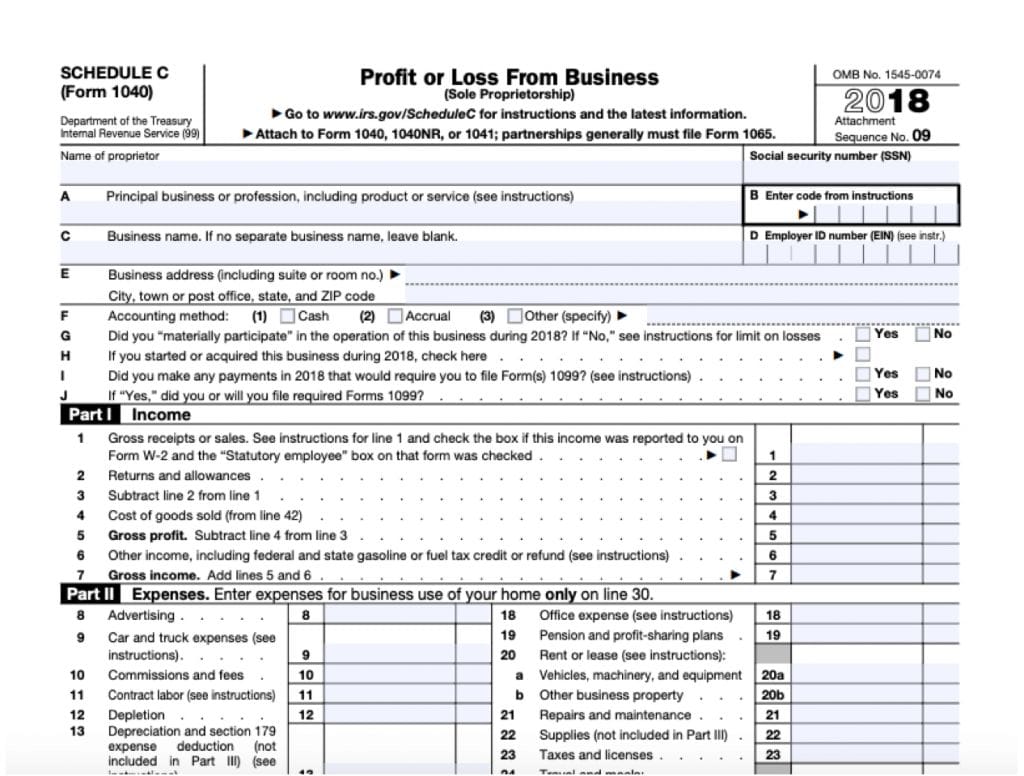

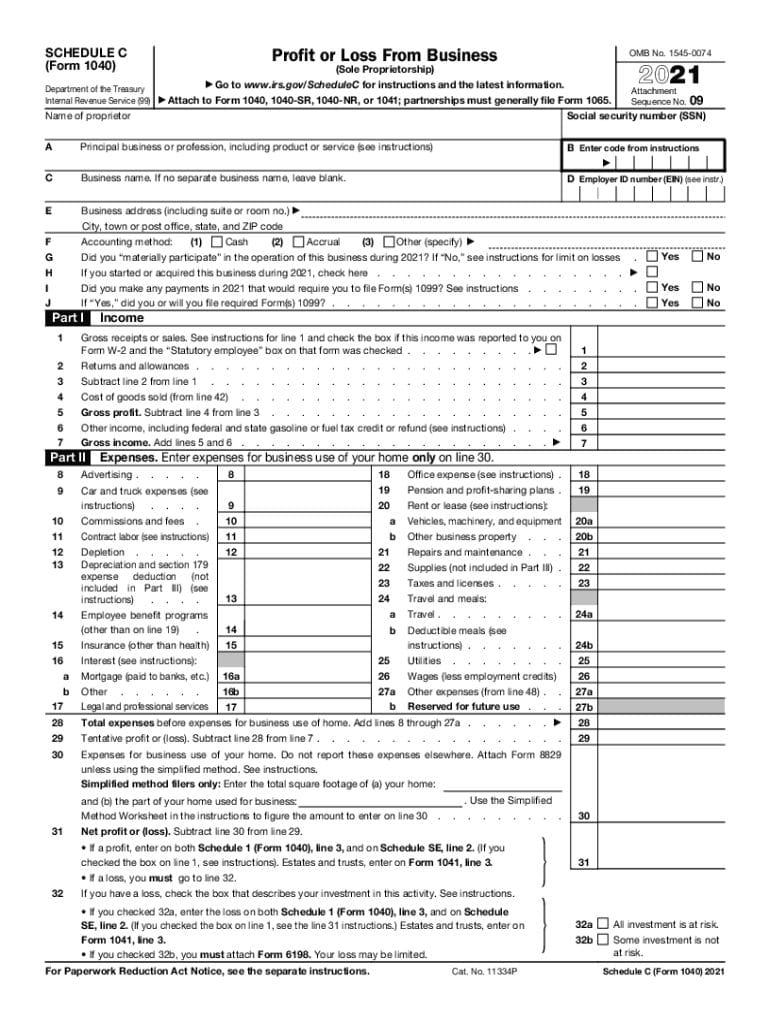

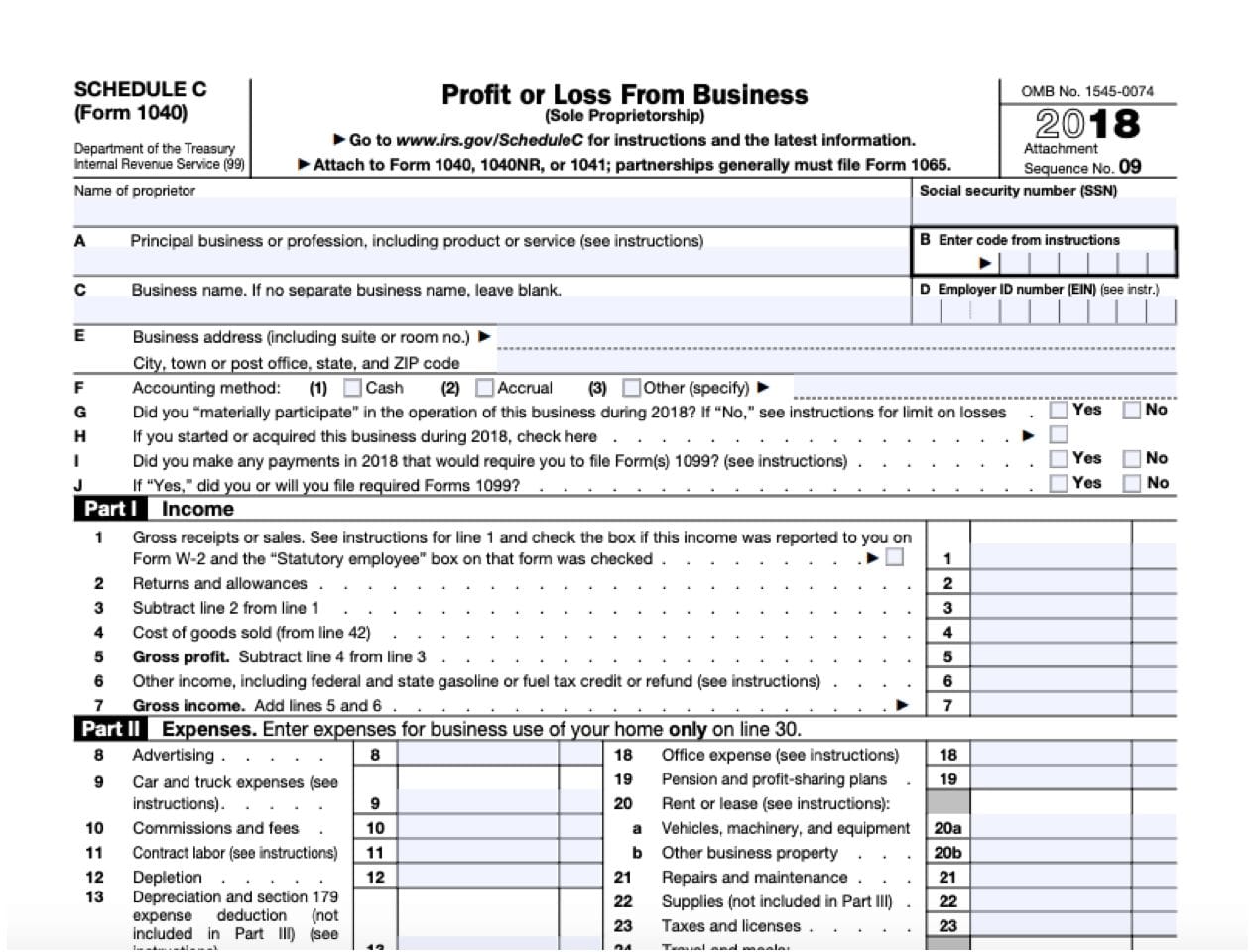

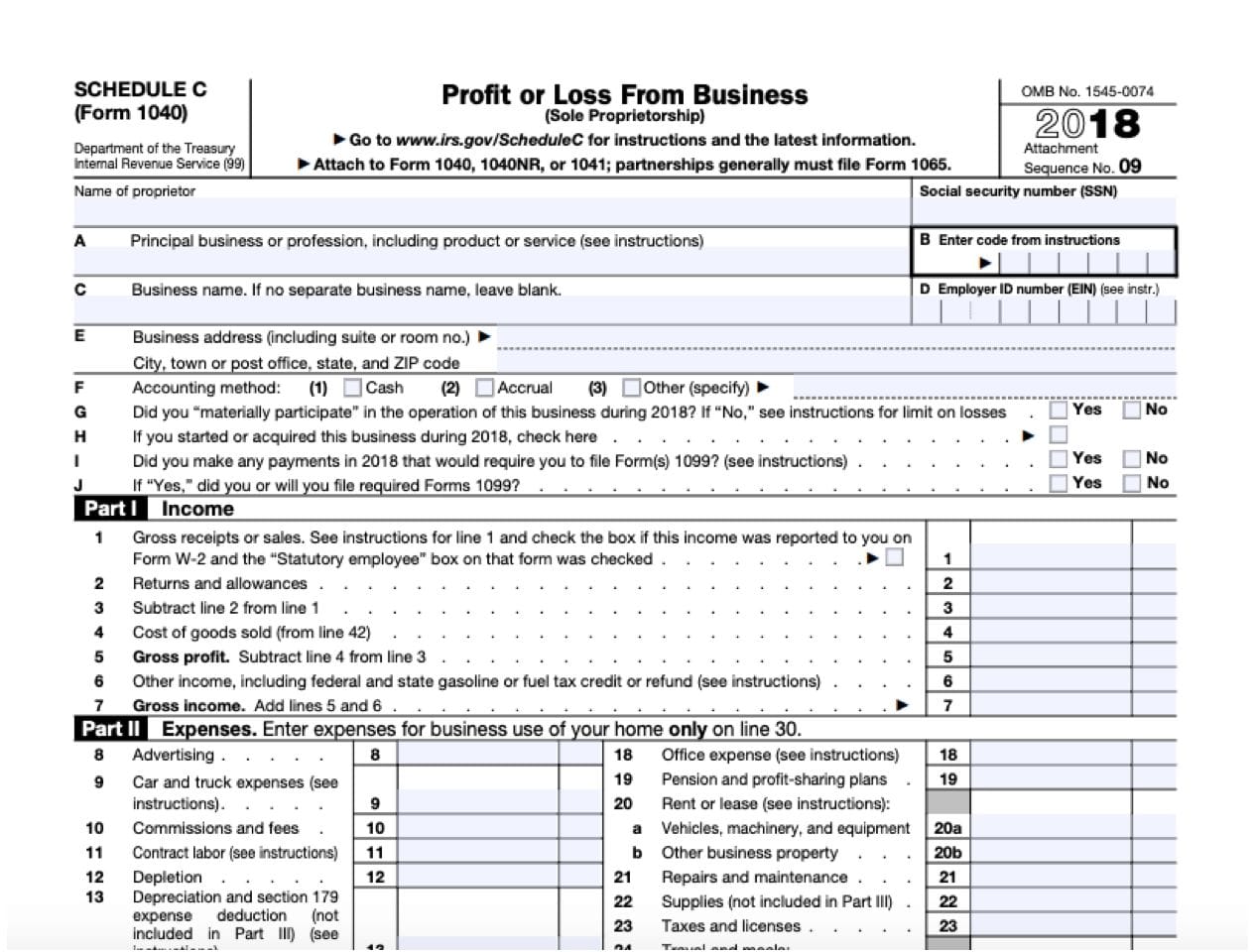

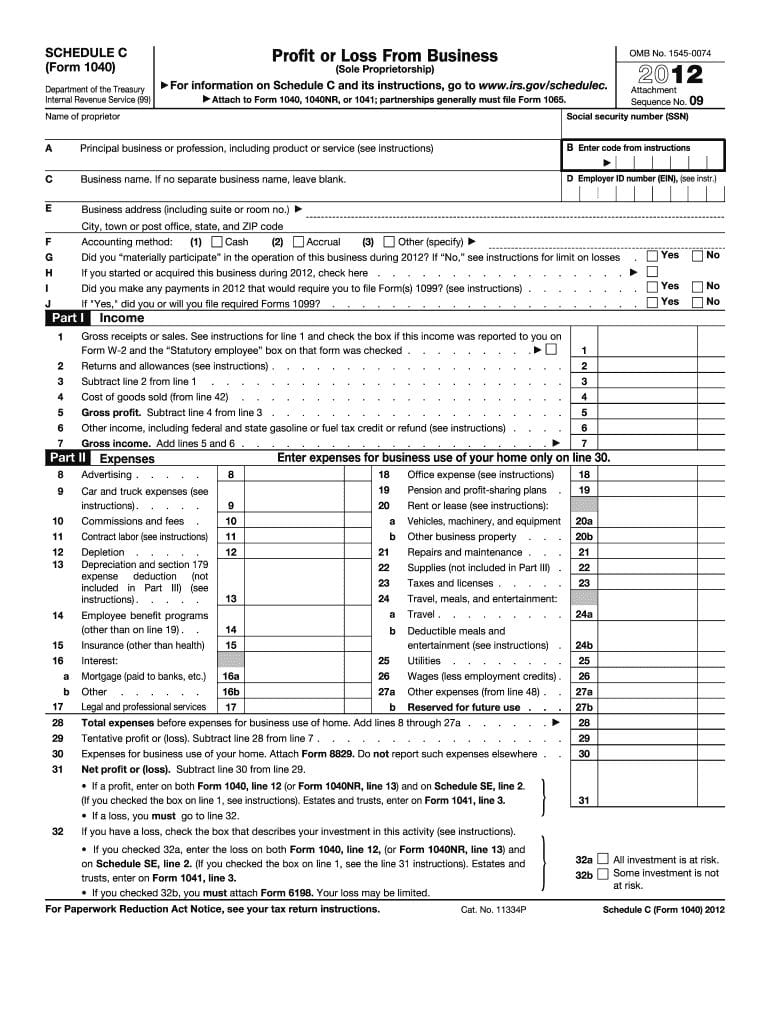

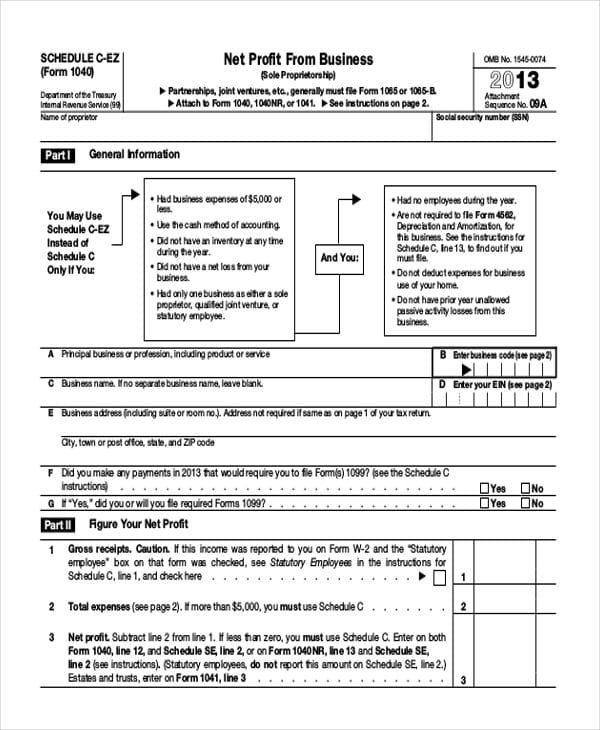

As a self-employed individual, you're likely no stranger to the complexities of tax season. One of the most important forms you'll need to file is the Schedule C (Form 1040), which reports your business income and expenses. To help you navigate this process, we've put together a comprehensive guide to the 2021 Schedule C form, including a printable template and expert tips to ensure you're taking advantage of all the deductions available to you.

Understanding the Schedule C Form

The Schedule C form is used to report the income and expenses of a sole proprietorship or single-member limited liability company (LLC). This form is an essential part of your tax return, as it helps you calculate your business's net profit or loss, which is then reported on your personal tax return (Form 1040).

Who Needs to File a Schedule C?

You'll need to file a Schedule C if you're a self-employed individual who operates a business or has a side hustle. This includes:

Sole proprietors Single-member LLCs Freelancers Independent contractors Small business owners

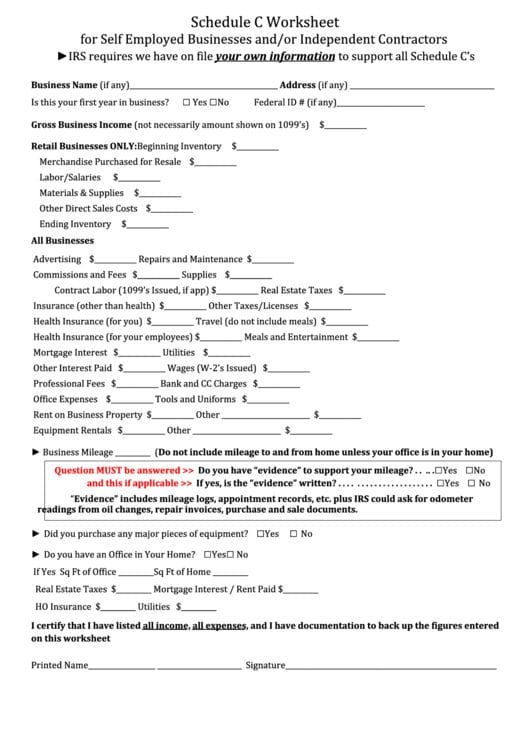

What You'll Need to Complete the Schedule C Form

To complete the Schedule C form, you'll need to gather the following information:

Business income statements Expense records Receipts for business-related purchases Depreciation records Information about your business use of your home (if applicable)

Step-by-Step Guide to Completing the Schedule C Form

Here's a step-by-step guide to help you complete the Schedule C form:

- Part I: Income Report your business income from all sources, including sales, services, and interest. Calculate your total income by adding up all the amounts reported in this section.

- Part II: Cost of Goods Sold Calculate the cost of goods sold by adding up the cost of materials, labor, and overhead. Subtract the cost of goods sold from your total income to get your gross profit.

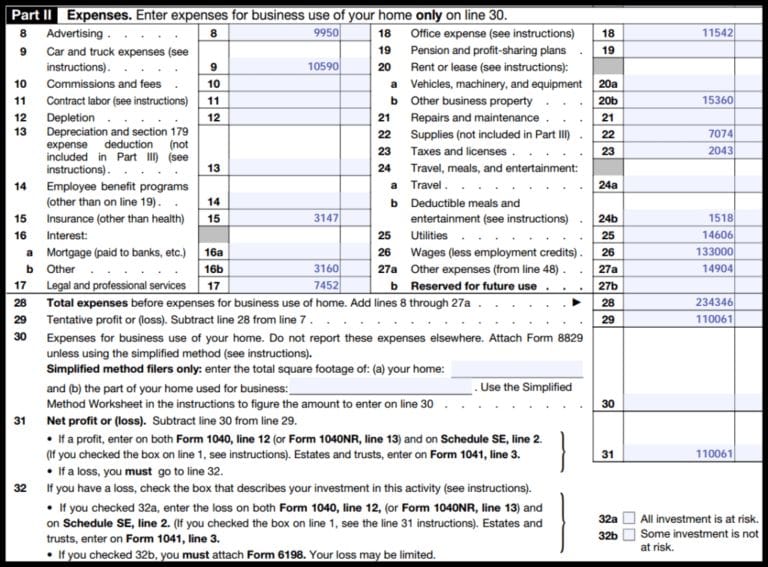

- Part III: Operating Expenses Report your business operating expenses, including rent, utilities, and supplies. Calculate your total operating expenses by adding up all the amounts reported in this section.

- Part IV: Information on Your Vehicle Report the business use percentage of your vehicle. Calculate the business use of your vehicle expenses, including gas, maintenance, and insurance.

- Part V: Other Expenses Report any other business expenses not reported in previous sections. Calculate your total other expenses by adding up all the amounts reported in this section.

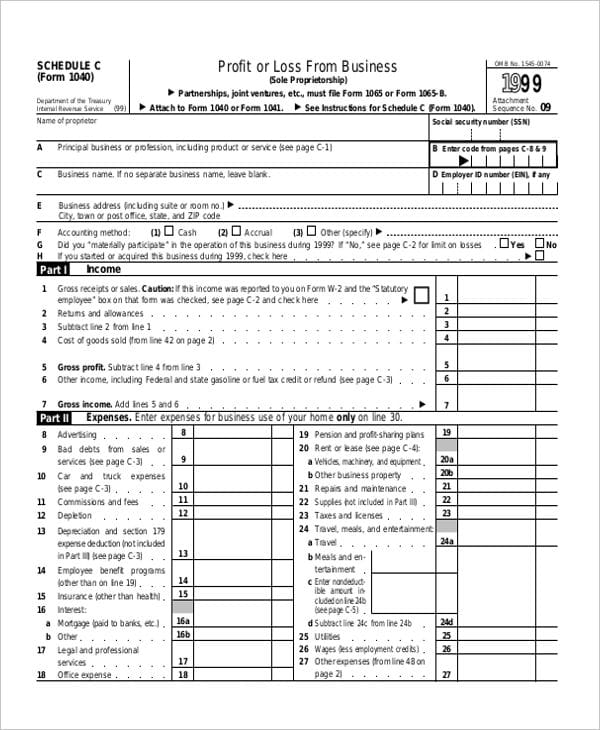

2021 Schedule C Form Printable Template

You can download a printable template of the 2021 Schedule C form from the IRS website or use the following template:

Schedule C (Form 1040)

Part I: Income

- Gross receipts or sales

- Returns and allowances

- Cost of goods sold

- Gross profit

Part II: Cost of Goods Sold

- Cost of materials and supplies

- Labor costs

- Overhead costs

- Total cost of goods sold

Part III: Operating Expenses

- Rent

- Utilities

- Supplies

- Total operating expenses

Part IV: Information on Your Vehicle

- Business use percentage

- Gas and oil expenses

- Maintenance and repair expenses

- Insurance expenses

Part V: Other Expenses

- Travel expenses

- Meals and entertainment expenses

- Miscellaneous expenses

- Total other expenses

Net Profit or Loss

- Gross profit

- Total operating expenses

- Total other expenses

- Net profit or loss

Tips for Filing the Schedule C Form

Here are some tips to keep in mind when filing the Schedule C form:

Keep accurate records: Make sure to keep accurate and detailed records of your business income and expenses throughout the year. Use a separate business bank account: Keep your business and personal finances separate by using a separate business bank account. Take advantage of deductions: Take advantage of all the deductions available to you, including the home office deduction and business use of your vehicle. Seek professional help: If you're unsure about how to complete the Schedule C form or need help with your tax return, consider seeking the help of a tax professional.

Conclusion

Filing the Schedule C form can be a complex and time-consuming process, but with the right guidance and preparation, you can ensure that you're taking advantage of all the deductions available to you. Remember to keep accurate records, use a separate business bank account, and take advantage of deductions to minimize your tax liability. If you're unsure about how to complete the Schedule C form or need help with your tax return, consider seeking the help of a tax professional.

FAQs

What is the Schedule C form?

+The Schedule C form is used to report the income and expenses of a sole proprietorship or single-member limited liability company (LLC).

Who needs to file a Schedule C?

+You'll need to file a Schedule C if you're a self-employed individual who operates a business or has a side hustle.

What information do I need to complete the Schedule C form?

+To complete the Schedule C form, you'll need to gather information about your business income and expenses, including receipts for business-related purchases and depreciation records.

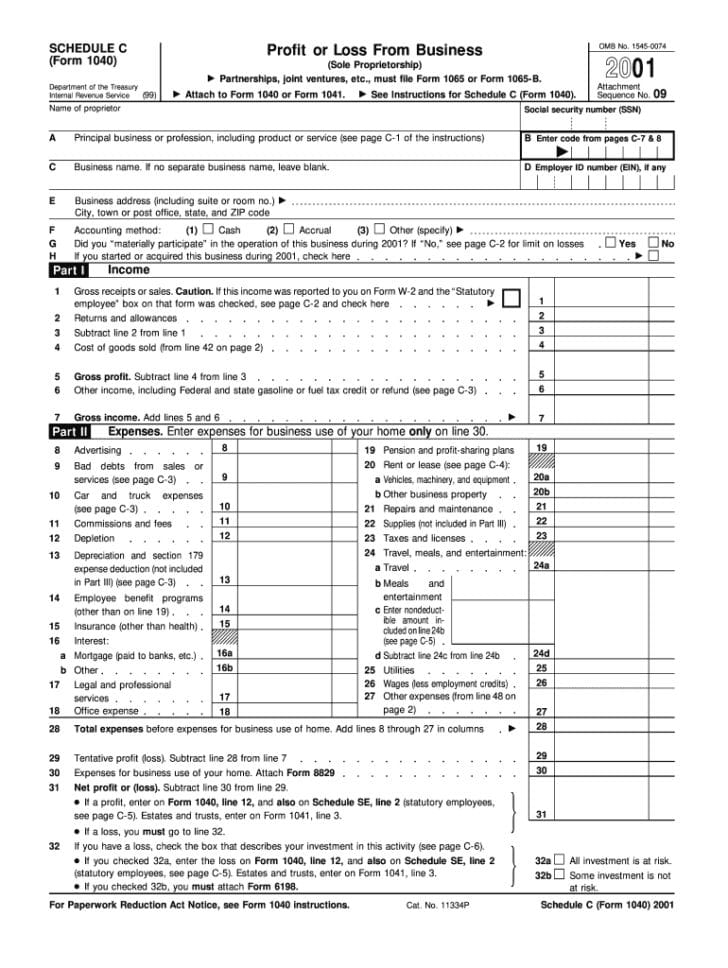

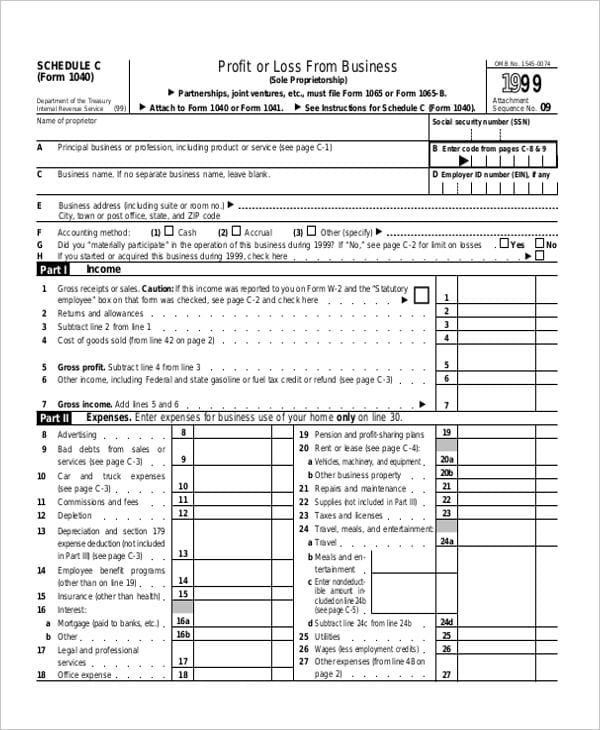

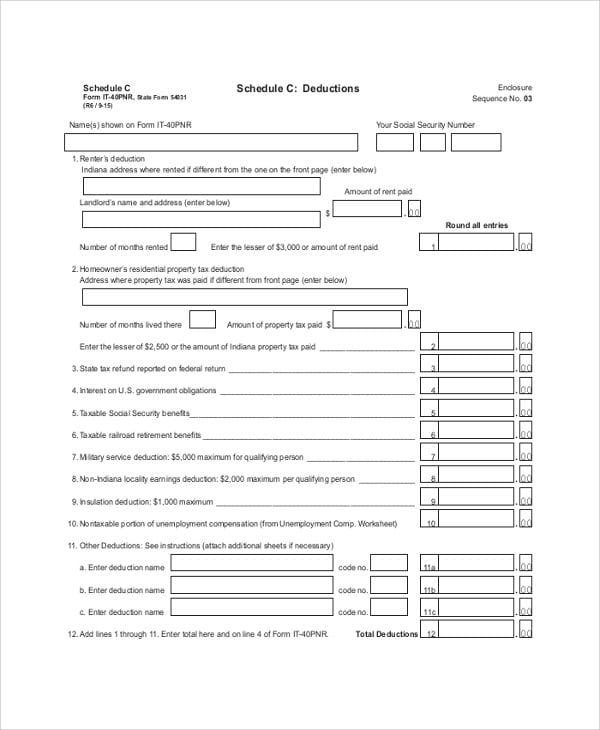

Gallery of 2021 Schedule C Form Printable Template For Self-Employed