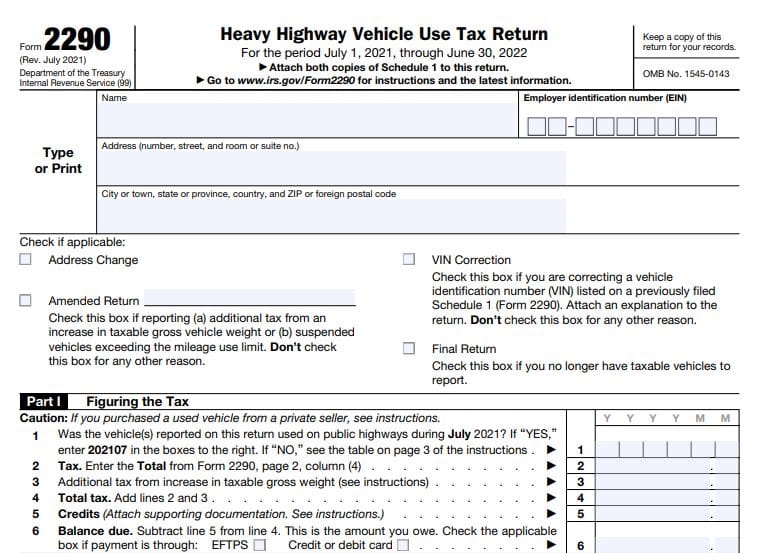

The Internal Revenue Service (IRS) Form 2290 is an annual tax return used to report and pay the Heavy Vehicle Use Tax (HVUT) for heavy vehicles with a gross weight of 55,000 pounds or more. The tax is due by the last day of the month following the month in which the vehicle was first used on public highways. Filing Form 2290 is a crucial step for taxpayers who own or operate heavy vehicles, as it ensures compliance with federal tax laws and helps maintain the integrity of the nation's transportation infrastructure.

Understanding IRS Form 2290

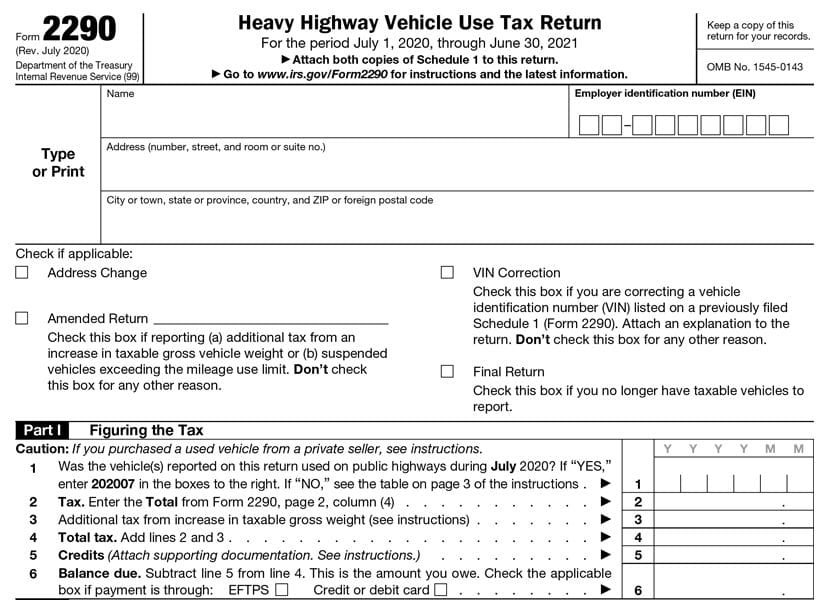

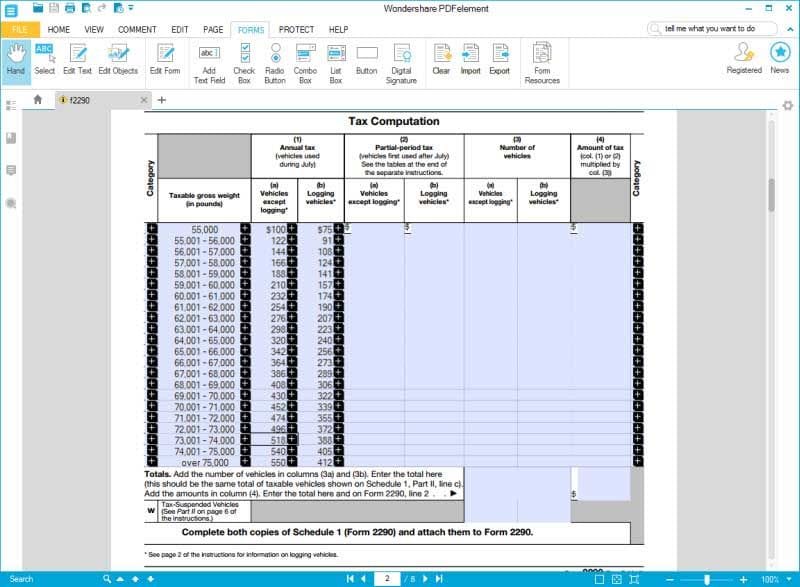

IRS Form 2290 is used to report the HVUT for heavy vehicles that use public highways. The tax is calculated based on the vehicle's gross weight and the number of miles it is expected to travel during the tax year. The tax year for Form 2290 runs from July 1 to June 30 of the following year.

Who Needs to File Form 2290?

The following individuals and organizations are required to file Form 2290:

Self-employed individuals who own or operate heavy vehicles Corporations, partnerships, and limited liability companies (LLCs) that own or operate heavy vehicles Trusts and estates that own or operate heavy vehicles Government agencies that own or operate heavy vehicles

Filing Form 2290 with a Printable Schedule 1

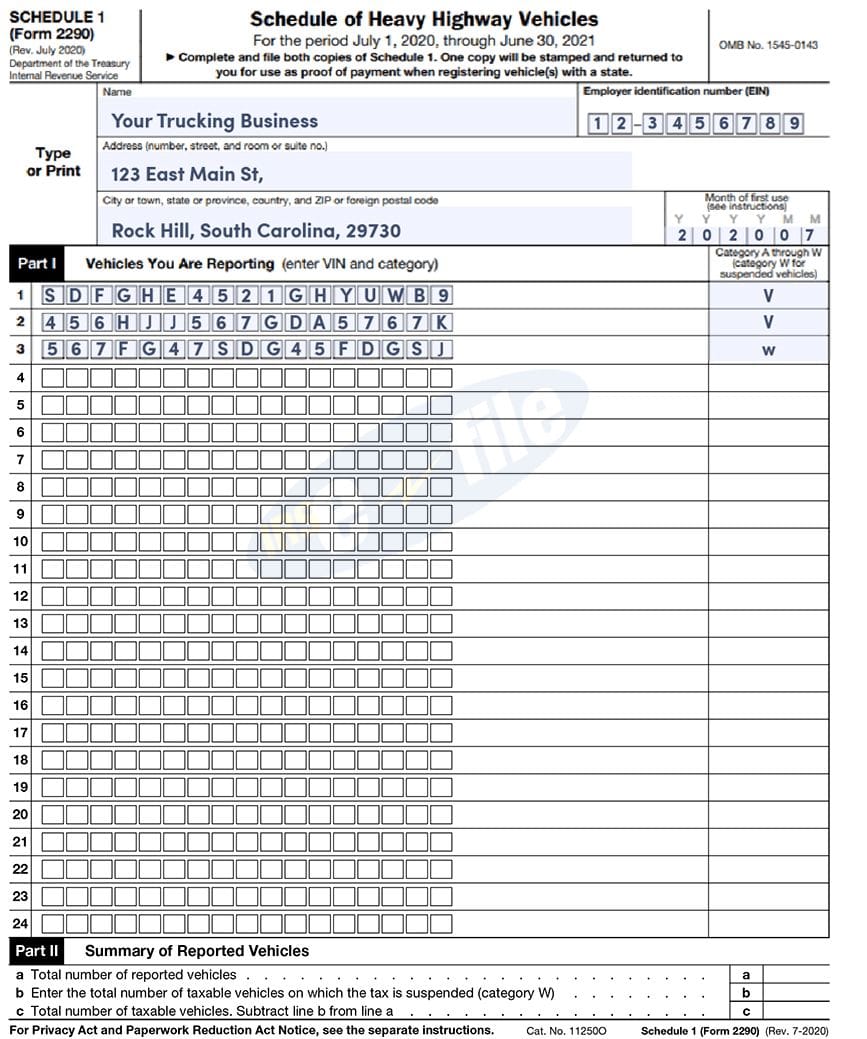

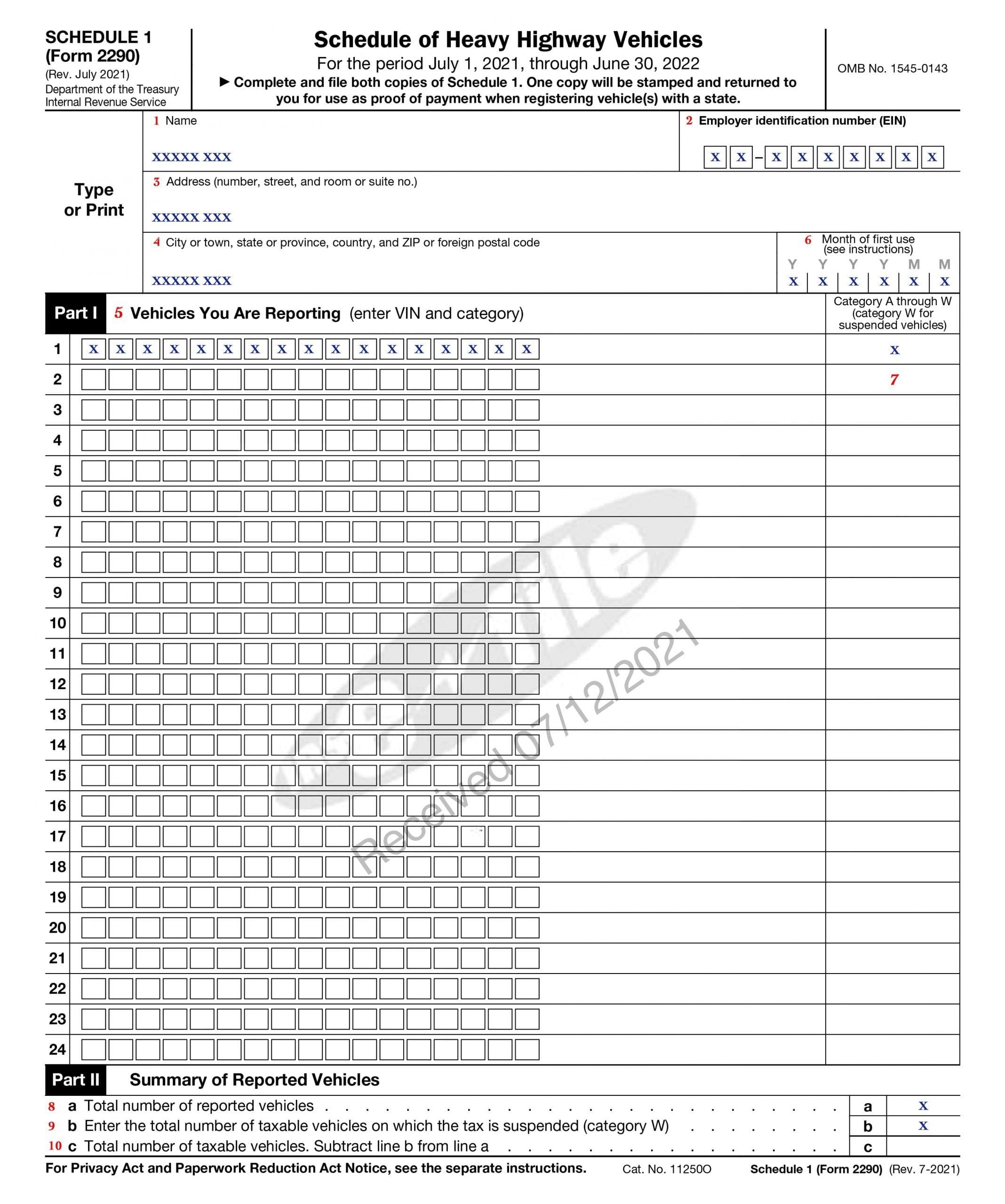

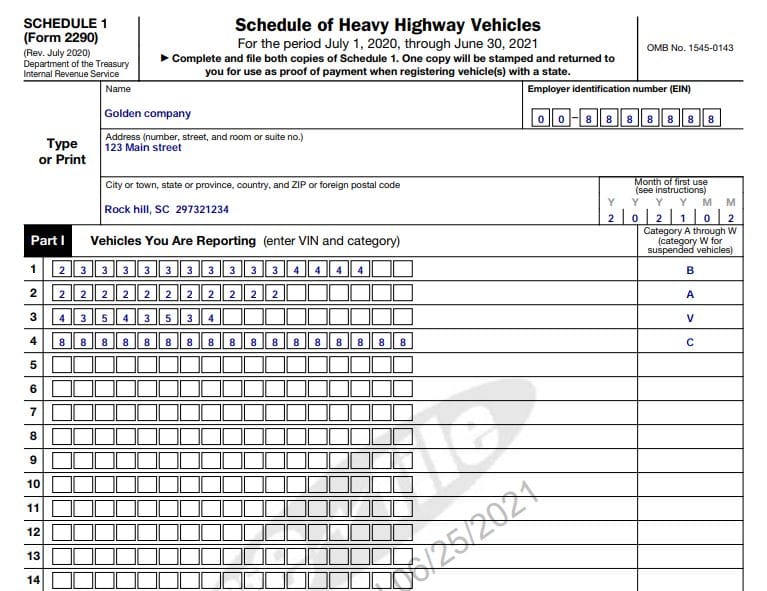

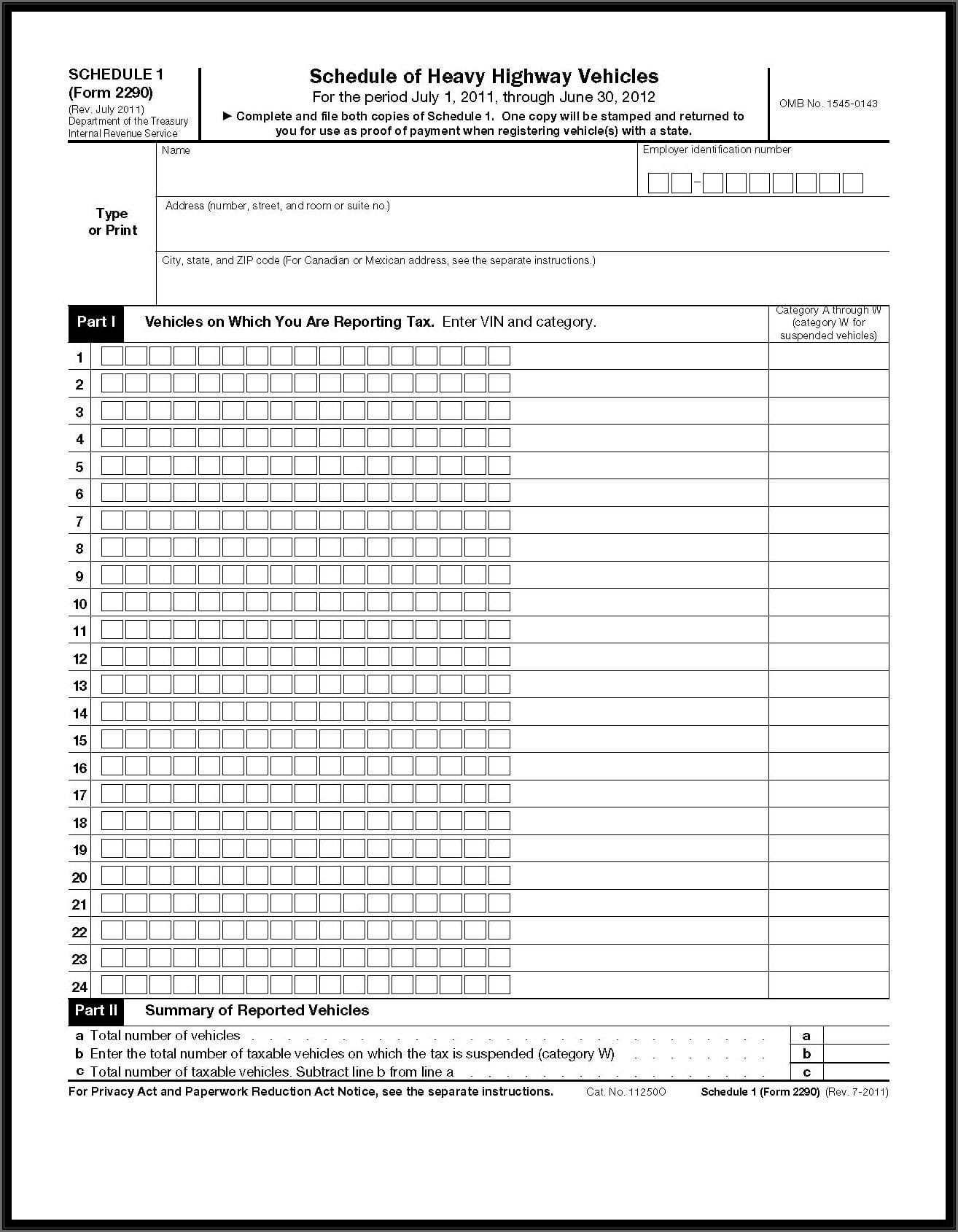

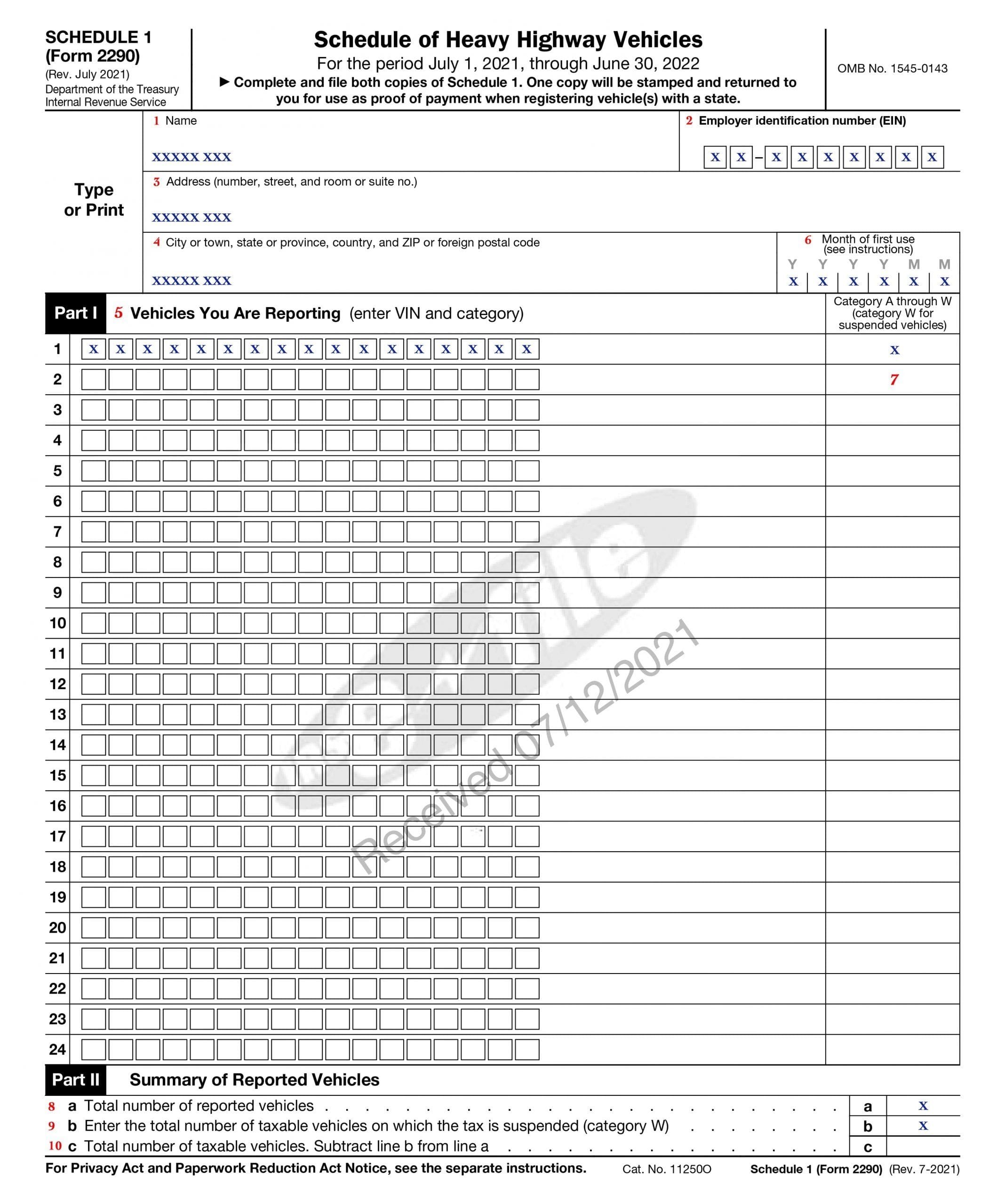

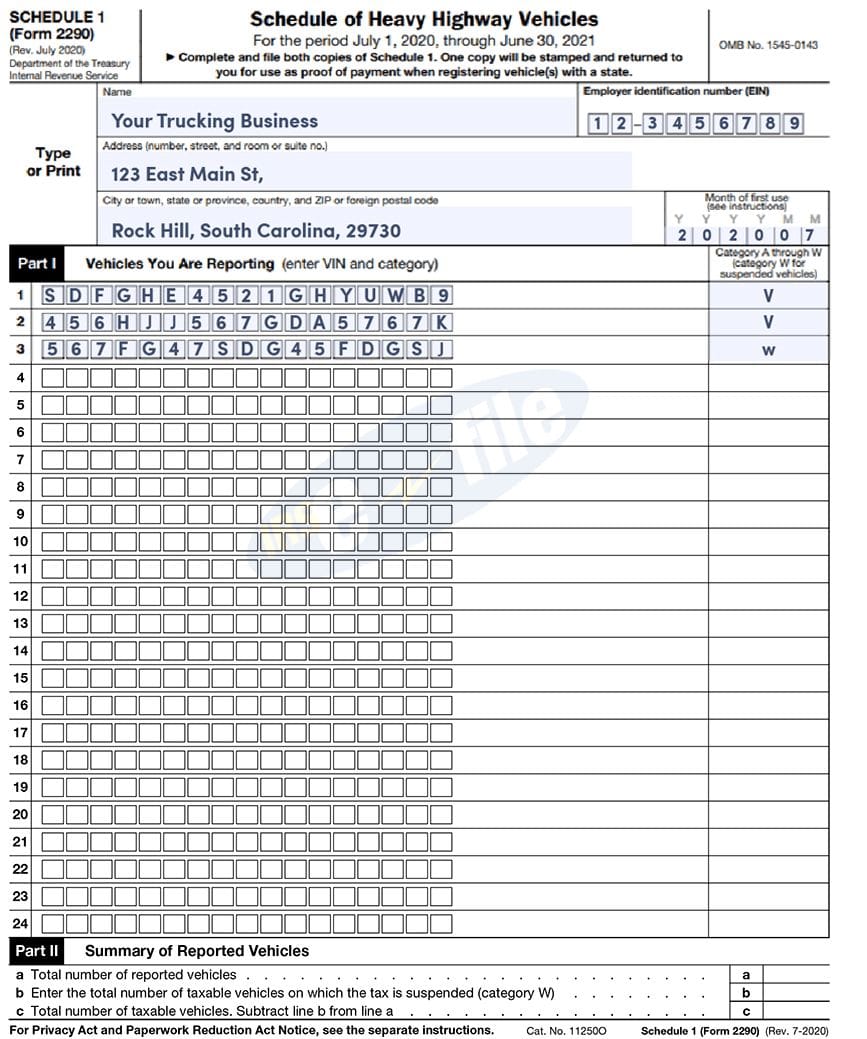

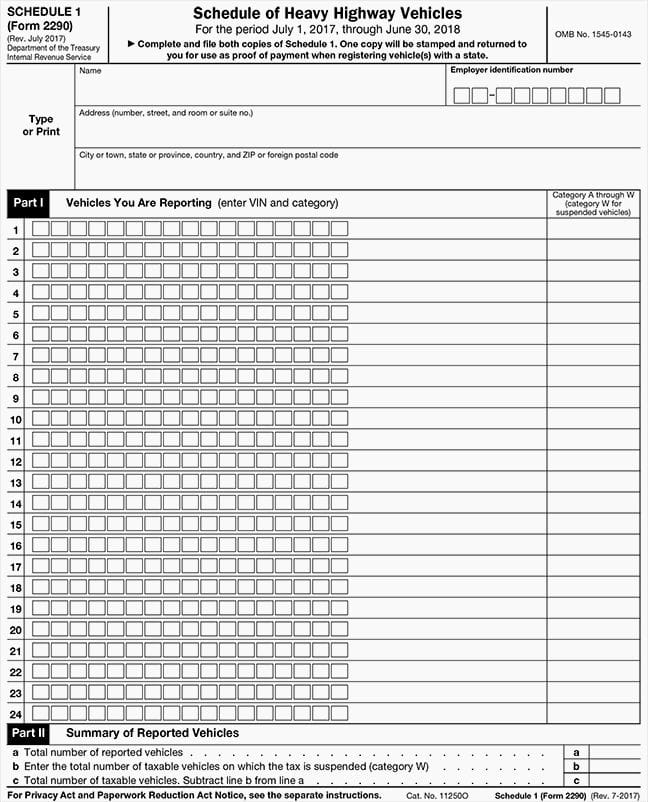

To file Form 2290, taxpayers will need to complete the form and attach a Schedule 1, which lists the heavy vehicles for which the tax is being reported. The Schedule 1 must include the vehicle identification number (VIN), the gross weight of the vehicle, and the tax due for each vehicle.

Steps to File Form 2290 with a Printable Schedule 1

Here are the steps to file Form 2290 with a printable Schedule 1:

- Download and print Form 2290 and Schedule 1 from the IRS website or obtain a copy from an IRS office.

- Complete Form 2290, including the taxpayer's name, address, and Employer Identification Number (EIN).

- Complete Schedule 1, listing each heavy vehicle for which the tax is being reported.

- Calculate the tax due for each vehicle, using the gross weight and mileage information.

- Attach Schedule 1 to Form 2290 and sign the form.

- Mail the completed form to the IRS address listed in the instructions.

E-Filing Form 2290

Taxpayers can also e-file Form 2290 using the IRS's Electronic Federal Tax Payment System (EFTPS). E-filing is a convenient and secure way to file the form and pay the tax online.

Benefits of E-Filing Form 2290

E-filing Form 2290 offers several benefits, including:

Faster processing time Reduced risk of errors Increased security Ability to pay the tax online

Penalties and Interest for Late Filing

Taxpayers who fail to file Form 2290 on time may be subject to penalties and interest. The penalty for late filing is 4.5% of the tax due, and the interest rate is 3.25% per month.

Conclusion

Filing Form 2290 with a printable Schedule 1 is a straightforward process that can be completed by following the steps outlined above. Taxpayers can also e-file the form using the IRS's EFTPS. It is essential to file the form on time to avoid penalties and interest. By understanding the requirements and benefits of filing Form 2290, taxpayers can ensure compliance with federal tax laws and maintain the integrity of the nation's transportation infrastructure.

What is the deadline for filing Form 2290?

+The deadline for filing Form 2290 is the last day of the month following the month in which the vehicle was first used on public highways.

What is the penalty for late filing of Form 2290?

+The penalty for late filing of Form 2290 is 4.5% of the tax due, and the interest rate is 3.25% per month.

Can I e-file Form 2290?

+Yes, you can e-file Form 2290 using the IRS's Electronic Federal Tax Payment System (EFTPS).

Gallery of Print And File Irs Form 2290 With A Printable Schedule 1